Diane’s farewell message

After 52 years at WAMU, Diane Rehm says goodbye.

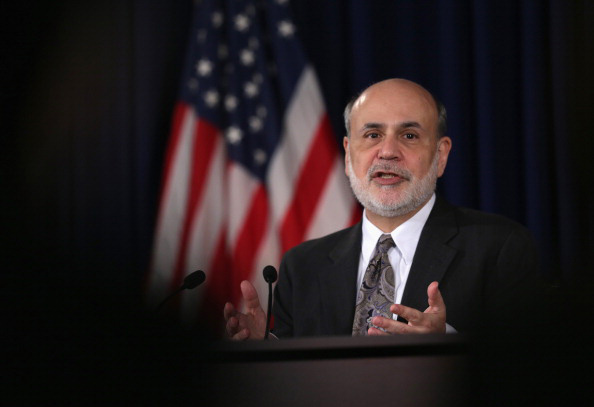

Ben Bernanke speaks during a 2013 news conference at the Federal Reserve in Washington, D.C.

When Ben Bernanke took over as Federal Reserve chair in 2006, the U.S. economy was going strong. But signs of trouble lurked beneath the surface. Just one year later, the housing bubble burst and big banks’ investments in subprime mortgages brought down Wall Street fixtures like Bear Stearns and Lehman Brothers. The U.S. economy entered the worst financial crisis since the Great Depression. During that time, the Federal Reserve went to unprecedented lengths to rescue the economy from the brink of disaster. Inside the U.S. financial crisis with former Fed Chair Ben Bernanke, and why he says bailing out Wall Street saved Main Street.

Excerpted from The Courage to Act: A Memoir of A Crisis and Its Aftermath by Ben S. Bernanke. Copyright © 2015 by Ben S. Bernanke. With permission of the publisher, W. W. Norton & Company, Inc. All rights reserved.

MS. DIANE REHMThanks for joining us. I'm Diane Rehm. Ben Bernanke took over as chair of the Federal Reserve in 2006. Just one year later, banks risky investments in subprime mortgages caused a global financial meltdown, the worst in the U.S. since the Great Depression. In a new memoir, the former Fed chair writes about his journey from small town South Carolina to the helm of the Federal Reserve.

MS. DIANE REHMHe defends the bailouts of Bear Stearns and insurance giant AIG, saying rescuing Wall Street was the only way to save Main Street. His new book is titled "The Courage To Act: A Memoir of a Crisis and Its Aftermath." Ben Bernanke joins me from the NPR bureau in New York City. We welcome your questions, comments, 800-433-8850. Send an email to drshow@wamu.org. Follow us on Facebook or Twitter. Mr. Bernanke, it's so good to see you.

MR. BEN BERNANKEOh, thanks for inviting me.

REHMIndeed. Mr. Chairman, it's been a year since you left the Fed. I wonder if that year has given you any new perspectives on the time you served as chair during that financial crisis.

BERNANKEWell, in the time since I've left the Fed, I've been spending most of it writing this book and it's just been a great opportunity for me to go back, look at the emails, the memos, the documents and to try to think through the whole thing again and very helpful to me, thinking it through. But as far as the economy's concerned, things have continued to move along in the same general direction they were when I left office.

REHMBut I wonder if, looking back through all those memos, letters, emails, you did gain any new clarity, any new perspective on that financial failure.

BERNANKEWell, the basic message that we had an awful financial crisis, one that nearly brought the U.S. economy, in fact, the global economy and that we had to attack with everything we had, and which we were able to prevent the financial system from collapsing, that's the basic story and I still think that's the right description. What was interesting for me was going back, looking at the real-time emails and seeing how we thought about it, you know, in real time.

BERNANKEYou know, with hindsight, it's easy to say, well, this, that, that had to happen. But, you know, in real time there's a lot of uncertainty. We were looking at lots of different scenarios, different risks so in the fog of war, the battle looks a lot different than it does when you have the leisure to look back at from a couple years later.

REHMSo looking back at it from a couple of years later, do you think that every decision you made was the best one you could've made?

BERNANKENo, of course not. Obviously, if we had been more foresighted and seen some of the risks earlier on -- and when I see "we," I mean, the whole regulatory community, that would've been, obviously, better. Once we identified the risk in 2007, we were very aggressive. I think, you know, we made some mistakes, but generally, we did all that we could with the tools that we had. I think if I look back and ask myself, you know, what one thing would I have done differently, you know, I made an effort, particularly after AIG and all that was happening, to communicate with the general public.

BERNANKEI went on television. I visited colleges. I gave speeches. I went on NPR, in fact, and I tried to explain, you know, what had happened and what was going on, why we did what we did. But, you know, evidently, you know, even more of that would've been probably desirable because there are a lot of people in the country who still, you know, don't understand what we did, think that we were bailing out Wall Street at the expense of Main Street, rather than doing what we were doing to try to preserve the health of the overall economy.

BERNANKEAnd without, you know, seriously probably some of the political reaction we're still seeing from the extremes of both right and left was related to that. And I wish that I had been better able to explain, you know, convincingly and broadly to the public, you know, exactly what was going on.

REHMBut I wonder, in addition to not explaining further what was going on, whether you, looking back, feel that you did make any mistakes that would have been better had you not done so.

BERNANKEWell, there were, you know, there were various tactical decisions...

REHMSuch as.

BERNANKEWell, one example -- well, a tactical decision example would be with the so-called TARP bill that -- the bill that Paulson proposed to Congress after Lehman Brothers to try to get support from Congress to stop the crisis. And initially, as I talk about in my book, Paulson took the view that the best way to sell the program was to talk about using the money to buy assets, to buy troubled assets. It was called, in fact, TARP is Troubled Assets Relief Program.

BERNANKEThe idea was to use the money to buy troubled assets from banks and other financial institutions and the idea was that that would take out some of those bad assets and help the system recover. Unfortunately, that turned out to be not viable in the short amount of time we had because the crisis was moving so quickly and the alternative strategy, one which I had proposed and been in support of, but also willing to accept Paulson's view, the alternative strategy was to use the money to actually put capital into the banks, that it so make public investments in the banks and strengthen them that way, rather than by buying assets.

BERNANKESo there was some, I think, some hesitation there in terms of, you know, which was the right strategy. I think ultimately we did settle on the right strategy, which was putting capital into the banks.

REHMBut you feel that the TARP strategy itself was a mistake.

BERNANKENo, no, no. Only the initial approach, which was to use the money to buy assets. Putting the capital in, which we ultimately did and which ultimately stabilized the system, was absolutely essential. It worked quite well and it's been the basis of substantial recovery in our banking system as our U.S. banks have really built up their capital and makes them safer and stronger.

REHMWhat about Lehman Brothers, Mr. Bernanke? Do you think that having or allowing that to fail was a good decision?

BERNANKEWell, that's something I go into in my book in great detail. So there's a general view, at least in some quarters, that the Fed and the Treasury decided, chose, to let Lehman fail. That just is not the case, as I document in my book. We were very eager to prevent its failure because we understood, unlike many of the media and other commentators at the time who were urging that we let it fail, we understood, I think, that if it failed, it would make the panic, which was already quite bad, it would make the panic even worse and threaten our economy and financial system even more severely, which, of course, is what actually happened when it did fail.

BERNANKESo we tried very, very hard to save it. We assembled all the leadership of the Wall Street firms and the New York Fed. We looked at every option we could find. But unfortunately, the tools that we had when we intervened with other firms were not available. So for example, in the case of Bear Stearns, in March of 2008, we had a buyer. JP Morgan bought Bear Stearns with some help from the Fed. In the case of Lehman, Bank of America and Barclays looked at the company and said, there's too much red ink here. We can't buy it. So that option was not available.

BERNANKEA second thing that we did, say, with Fannie and Freddie, was to put, in some cases, was to put capital in, that is to make it equity investments. But this was before the TARP and so we didn't have that authority. We didn't have any capital to invest in so we didn't have that option. The third option would've been to lend against collateral, provide enough cash, which is what the Fed can do as a lender of last resort, to allow Lehman to make its short term payments and survive as a company. And we looked at that. In fact, we lent them quite a bit of money.

BERNANKEBut unfortunately, they just did not have -- I mean, they were very insolvent. They were in bad financial state. There was a huge run going on and, you know, we simply did not have enough collateral from Lehman that we could lend against to make loans that would prevent their collapse. So bottom line, as I talk about in the book in some detail, we wanted to save Lehman. We knew it would be a big problem if they failed. It was even a worse problem than we expected, probably. But we just didn't have the tools and we couldn't do it. It wasn't a choice.

REHMHow did Lehman get into such a terrible situation?

BERNANKEWell, you know, the whole financial system was under tremendous stress because, first of all, the losses on subprime mortgages and on housing more generally, spread into all kinds of other securities. And I think this is something that needs to be appreciated is that when investors pulled back from subprime mortgages, they pulled back from credit cards and auto loans and all kinds of other credit as well, even though there was no reason and sense that those loans weren't going bad the way the subprime mortgages were.

BERNANKESo anyway, there was a big panic that drove down the prices of credit, prices of risky assets. Lehman had taken a lot risks, had really put -- exposed itself to the subprime mortgages and to other tricky credits, including commercial real estate. They had also -- so they had taken a lot more risks than a lot of companies. They had also not done a great job of building capital and getting investors to put money into them. And finally, maybe people don't realize Lehman Brothers, the holding company that ran the company, did not have a regulator.

BERNANKEThat is, there's no law which said that any -- the Fed did not regulate them. The SEC regulated them on a voluntary basis, but there was nobody really who could tell them, get your act straight. Secretary Paulson and Secretary Geithner did talk to them quite a bit, but they never were able to raise the capital they needed.

REHMBen Bernanke, former chair of the Fed and his new book is titled "The Courage To Act: A Memoir of a Crisis and Its Aftermath." Short break, we'll be right back.

REHMAnd welcome back. Ben Bernanke is with me. He is, of course, the former chair of the Federal Reserve, which he began serving in 2006. And as we all recall, just a year later the banks' risky investments in subprime mortgages caused a global financial meltdown. We've got a number of questions, tweets, comments. Here's the first and I know you've talked about this earlier with our colleague Susan Page of USA Today. William, in Maryland, says: Why have no criminal charges been filed, why has no one gone to jail for the financial collapse of 2007, 2008? Until such action takes place, it appears to the public it's business as usual on Wall Street and this tragedy will occur again, all too soon, in simply another form.

REHMFirst, let's take the latter part of that question. Do you think it's possible, Mr. Bernanke, for that kind of collapse to happen again?

BERNANKEWell, I don't think we can ever guarantee there won't be another financial crisis. We've had those since the tulip bulbs in the Netherlands hundreds of years ago.

REHMYes.

BERNANKEAnd if you're going to -- if you have risk-taking in a society, which you need for the dynamism we need, then there's going to be risk. But I think the main thing is to do what we can to make sure that, if it does happen, it doesn't have the impact or, you know, the impact on the economy, in particular, that this one had. And a lot of the reforms that have taken place since then have moved us in the right direction.

REHMHowever, no one has yet gone to jail for what happened. You told our colleague, Susan Page, that you felt perhaps someone should have gone to jail.

BERNANKEWell, first, it's not true that nobody's gone to jail. There have been a number of people who have gone to jail for trading rigging and things of that sort. But what I told your colleague and what I would say again is that it wasn't so much a judgment on, you know, whether these decisions were just bad judgment or criminal decisions, the problem is -- and I think your listener is getting at this -- is we haven't necessarily always found out.

BERNANKESo the criticism I had was only about the fact that the Department of Justice, in investigating these issues, had -- at least for a long time -- was very focused on penalizing financial institutions as a whole, charging large fines, but typically did not go after individuals. And, of course, you know, corporations are legal fictions. They don't commit crimes, really. It's only individuals who run them or...

REHMRight. Right.

BERNANKE...or who are employed by them.

REHMYeah.

BERNANKESo if there were such serious violations, I think it would have been a better strategy to go after the individuals. Now I want to be clear, I don't know, in each case, what such investigations would have found. It might have been that the losses were bad judgment rather than criminal in intent. We don't know. But by not going after individual decision makers, I think that we lost some opportunity to get more clarity on that.

REHMConsidering how serious the results were, however...

BERNANKEMm-hmm.

REHM...and the fact that the FBI has gone after institutions -- the Justice Department has gone after institutions, should they not have gone after individuals? And do you, to this day, believe that some individuals who were responsible for the decision-making process should, even now, go to jail?

BERNANKEWell, let's be clear. This was a very complicated phenomenon.

REHMOh, I understand that.

BERNANKELots of people made mistakes, including the Fed, including regulators, you know? So it's not illegal to make mistakes. It's illegal to deceive. It's illegal to, obviously, to break the law. And my concern -- and I don't know what the outcome would be -- my concern was that the strategy pursued by the Department of Justice was more about, let's penalize institutions as a whole, ask for big fines, billions of dollars in fines -- which, of course, is glad that, you know, there was some penalty paid -- but in doing so, not holding accountable individuals.

BERNANKENow, again, what exactly would have happened, you know, and how many cases you would have found criminal to culpability I don't know. And that's just my concern that we didn't necessarily follow through on that. The Fed, by the way, is not an enforcement agency. The Fed didn't have any authority to put anybody in jail. So that was why we weren't engaged in that.

REHMGive me an example of some of the mistakes that the regulators made.

BERNANKEWell, I mean, I think the most important one -- there were probably a number of them -- but one of the most important ones was not acting early enough and aggressively enough to stop the bad lending. You know, I mean the regulators didn't make the loans. They were made by financial institutions and ultimately it's their responsibility. But the Fed and other regulators had some responsibility to make sure that, you know, that these decisions were consistent with safety and soundness. And for a lot of reasons, including problems with the structure of the financial system and financial regulatory system itself, we didn't get that done.

REHMMembers of Congress took aim at Freddie and Fannie Mae.

BERNANKERight.

REHMHow do you feel about those two institutions now?

BERNANKEWell this is actually, this is one place -- I mean, again, the Fed has been criticized for not seeing some of the weaknesses -- this was one place where the Feds had been very critical for quite a few years. My predecessor, Chairman Greenspan, frequently expressed concern in Congress about Fannie and Freddie, arguing that they were too thinly capitalized and that they were in danger, in a bad crisis, of not only failing themselves but bringing down the rest of the system. That was a point that I made as well, in advance of the crisis.

BERNANKESo when, you know, when the housing crisis came and their losses were so extreme, Fannie and Freddie basically went bankrupt. They were taken over by the government. They're still essentially wards of the state. They play an important role in the mortgage market and so it's not so simple as just to shut them down. But that remains an unresolved issue from the crisis.

REHMDo you believe they should be shut down?

BERNANKEWell, not without some replacement, no. Because right now they are the mortgage market. If you are a bank and you make a loan to a customer, a mortgage loan, then the only place -- other than holding it on your books, which you may not be able to do -- the only option you have is to sell that loan to Fannie or Freddie, who and then, in turn, resell it to investors. We need some institutions that perform that service. There have been a number of proposals to replace Fannie and Freddie with private sector alternatives, for example. But right now, you know, they're complicated proposals and, so far, Congress, which has not been very active lately, as you know, has not really put anything forward that, you know, as a sound replacement.

REHMHere's a question from Thomas on our website. In retrospect, does Chairman Bernanke think it was a mistake not to have dropped interest rates to zero in September of 2007 instead of December? And if the first quantitative easing should not have been larger and lasted until markets were expecting the price level to return to and continue on its pre-crisis trend?

BERNANKEWell, in September of 2008, not 2007 -- that was when Lehman failed. And we had a meeting that -- immediately the next morning. In fact, I was on the phone well into the meeting talking with the New York Fed about AIG, which was on the precipice at that moment. And, you know, we had essentially agreed among us the previous week, before this all happened, that we would wait and see and not cut rates in September of 2008. We had very little time and so we ended up not cutting rates at that particular meeting. And I talk about it in my book and I acknowledge that that was probably a mistake. We did cut rates down to zero by December of 2008, as your questioner notes. And then, in March, we did a very big quantitative easing program.

BERNANKESo, you know, we did ultimately make a very aggressive monetary response to the crisis. Probably even a little quicker would have been good. I guess I would point out that the Fed, by far -- compared to other major central banks -- was by far the quickest to cut rates and to go to quantitative easing.

REHMIt's remarkable that you said that the recent financial crisis was the worst in human history, even worse than the Great Depression. But that's where I think an awful lot of people wonder, if it was so big, why didn't you see it coming and why couldn't you have done something to stop it before it happened?

BERNANKEWell, again, we were aware of the fact that house prices were very high. And we thought it quite possible that they would correct at some point. By 2006, 2007, we also were aware of the problems in the subprime lending market. What we did not anticipate and no one anticipated was the vulnerability of the financial system overall to a run, a panic. You know, in the 19th century, early 20th century, we had bank runs all the time. People would run to the bank, pull their cash out and the bank would have to close. That was this, in the 1930s story. So now we have deposit insurance. We didn't see that coming.

BERNANKEBut there's still a lot of short-term money in banks -- whether it was lent through what's called the repo market or -- in any case, money that is not insured, which ran just like the old-fashioned depositors ran. And, you know, we -- there was just not enough appreciation that that was possible or that it would happen. Once it happened, it brought the whole financial system down, essentially to its knees. And then, you know, the rest is history, as they say.

REHMDo you still believe that institutions, no matter who or what they are, are too big to fail?

BERNANKENo, of course not. And the reason we intervened with Bear Stearns and AIG was not out of any consideration for those firms or their shareholders. Rather, we were in the middle of a financial panic -- one of the, certainly one of the worst in history, if not the worst -- and we were aware that if those companies failed, as Lehman failed, that the crisis would get even worse and that the financial system might essentially freeze up and that, therefore, the economy would suffer a body blow. So during the middle of the financial panic, we acted to prevent the panic from getting worse.

BERNANKENow it's incredibly important to address the too-big-to-fail problem in calmer times. And after the panic was over, there's been a lot of effort to reduce the problem. And I don't know how much you want to spend on it. I can certainly talk about it for quite a while. But, basically, the large financial firms, like big banks, have been required to hold a lot more capital, with the biggest banks holding more capital than others. They also have to have -- they have to borrow money in ways that can be converted to capital if they get into trouble. So the banks are a lot more resilient now. They have a lot tougher oversight, tougher rules.

BERNANKEAnd very importantly, the Dodd-Frank Bill gave the Fed and the FDIC the authority to unwind -- essentially do a rapid bankruptcy process -- to unwind a failing firm, to make sure it's not too big to fail but at the same time to protect the rest of the system as you do that. So we've made progress there. I'm not saying this problem is solved. But it's of utmost importance to keep working to make sure that there is no firm that's too big to fail and that every firm has to compete on a market-based, level playing field.

REHMOne more question about Lehman Brothers. Had the Fed decided that you would pump more money into Lehman avoided its failure, could the financial crisis itself have been avoided?

BERNANKEWell, let me first emphasize, again, that we did not have a way to save Lehman. Putting money into it would have just allowed its creditors to pull out their cash and just left us with a, basically, a failed firm. Now, so as I said, we didn't have a way to save the firm. But as I discuss in my book, you know, it's a question about what would have happened if we had somehow found a way -- maybe with a buyer -- to prevent Lehman from failing, we would have put off the intensification of the panic. It was already bad but it got a lot worse after Lehman. If we had been able to save it and saved AIG as well, we might have been able to put it off a little bit.

REHMHmm.

BERNANKEBut the problem was that the Fed was running out of tools. We were basically out of ammunition. And after Lehman and AIG, then there was six or eight or other, 10 additional firms that were getting into trouble. And ultimately, I think, something would have failed unless Congress intervened.

REHMAnd you're listening to "The Diane Rehm Show." And now we hear concerns about student loans and whether they have become so large that they, too, could eventually hurt, seriously hurt the American economy and its ability to move forward. What are your thoughts?

BERNANKEWell, there are about a trillion dollars of student loans outstanding, so it's a big debt. I think you should understand that it is not money that's been lent by our banks and the financial institutions. It's money mostly that's been lent by the U.S. Government. So it's more of a fiscal issue in that respect than it is a financial stability issue. So it -- one thing we can say is student loans are not going to bring down the banking system the way the subprime loans did because banks are not exposed to those loans.

BERNANKENow, where they are a problem potentially is where you have students who have had large amounts of loans and, particularly if they didn't graduate or they don't have a job, how are they going to pay that back? And that's going to affect their ability to buy their own home or to buy a car or to move on in life. So that's the big issue. It's a tough question because the basic purpose of student loans, of course, was to make sure that everybody who had the desire and capacity would be able to attend college, even if they didn't have the money, if their family didn't have the money.

BERNANKESo it's a good thing that people can get loans in order to get education and build up their skills. The problem is that, in some cases, people have borrowed too much or they've borrowed money that didn't lead to them -- to the career expectations they had. So I guess my response is that we need to find ways to work with those students, the ones who are overburdened -- I have a few folks in my family actually who had the same issue -- and so that they can find ways to pay back that will, you know, not prevent them from, you know, building their own lives.

BERNANKEThe other thing is that I think we need a little bit more counseling and guidance. Because there are people who take out loans -- there have been plenty of examples of people who've taken out loans for unrealistic programs, who have been cheated by the university or college that they, you know, that they have enrolled in -- or misrepresented, anyway. So I think, you know, helping students in advance, before they take out the money, understand better, you know, what the costs are, what their job expectations are going to be, that probably would help prevent the problem before it got started in some cases at least.

REHMFormer Chair of the Federal Reserve, Ben Bernanke. His new book is titled, "The Courage to Act: A Memoir of a Crisis and Its Aftermath." We'll take a short break here. When we come back, we've got lots of callers. We'll get to as many as we can.

REHMWelcome back. Ben Bernanke is on the line with me from our NPR studios in New York. He has a new book. It's titled "The Courage to Act: A Memoir of A Crisis and Its Aftermath." Mr. Bernanke, whose courage are you speaking of here in the title?

BERNANKEWell, I dedicated this book to the policymakers around the world who did what it took. This was a very scary and uncertain situation. The situations that had to be taken had huge stakes, were done, taken in chaotic circumstances, and importantly there was obviously a very tough, one might even say poisonous political environment when all these decisions were being taken. And I do believe that as important as making the right analytical decisions is having the willingness, the courage to put it into place. And around the world, central bankers and finance ministers, treasury secretaries, did what was needed in the face of a lot of blowback to try and get done what we had to get done, which was to prevent the system from collapsing.

REHMAll right, let's open the phones. We'll go first to Jean in Greensboro, North Carolina. You're on the air. Go right ahead, please.

JEANThank you so much, Diane, and thank you, Mr. Bernanke. I'm a Carolinian, and I hope you're dry, considering the hurricanes that have come through your state. One of my favorite books is by the political journalist Theodore White. He wrote the book "In Search of History." And one of the points that he makes is the purpose of the government is to protect people, to protect the people.

JEANAnd I would like to know how you embraced that philosophy in your role as chairman of the Fed. I hear you talk a lot about the institutions, but I'm waiting to hear you talk about more the consequences of our financial policies at that time on the people of the United States. Thank you.

BERNANKEWell, that's a terrific question and very fair. As an economist, I tend sometimes to drift off into the technicalities, but I was raised in a small town in South Carolina. I worked construction. I waited on tables. I worked in my father's drugstore. And I understand it's tough to make a living. I really appreciate that. In my career, I never worked on Wall Street. I was a professor. I enjoyed talking to students and doing research, and my research included a lot of work, by the way, on the Great Depression and the effects that had on people.

BERNANKEAnd, you know, all the discussion, it gets very technical about monetary policy, about financial markets, but ultimately the -- what we were trying to do and what is the objective of the Fed is to help ordinary people, is to make sure that if you want to find a job, you can find a job, that you're not dealing with erratic, high inflation and that the economy is producing health results for ordinary people across the country.

BERNANKEAnd that was always my motivation. I remember, just if I could tell a quick story, when I was in the White House, I was actually in the White House after Katrina, and the White House economic staff had been trying to find solutions, you know, for the tremendous disaster that happened in New Orleans. And I was on a call-in show very much like this one, and I'd been explaining, you know, how the economic policies were going to be applied so that New Orleans could recover and so on.

BERNANKEAnd the first caller said, you know, sir, I think you're so wrapped in your numbers, you forgot the people involved. And that lesson was a good lesson for me. I think whenever you look at the numbers every month and how many jobs have been created and how many people are unemployed and what's happening to people's family incomes, you have to remember that these are real people that are across the country, and it helped me, again, coming from a small town in South Carolina. Having those experiences myself really helped me think about the consequences of what we were doing as policymakers for average people. And that was what motivated us in all decisions we took.

REHMAnd of course the job numbers this month were far lower than what economists had expected or hoped for. I mean, people are still hurting. And there is this tremendous disparity between that wealthy one percent and the rest. What can economists, the Fed, the government, do to help people who are unemployed and at the same time improve the economic outlook?

BERNANKEWell, what the Fed can do is basically two things. It could help the economy recover from a deep recession, and a lot of that has happened. The unemployment rate was 10 percent in 2009. Now it's about five percent. We've created millions of jobs. And so we've made a lot of progress to recovering from the recession. The Fed can also keep inflation low, and it's been doing that, obviously.

BERNANKEBut what the Fed cannot do is, you know, create productivity, create skills, create technology, to do things that make the economy stronger in the long run, and it also cannot -- doesn't really have the tools to make sure that the benefits of growth are equally shared across the population. The government can do things there. The government can, for example, help improve education, training and skill acquisition. It can provide the necessary infrastructure. It can support research and development.

BERNANKEThere's lots of things that can be done over time to make the economy stronger and to help people in the middle of the income distribution. Most of them are not what the Fed can do. I wrote an op-ed just the other day saying the Fed has done a good bit of what it can reasonably be expected to do. It's time for others in the government and the private sector to step up and try to make sure that the fruits of the recovery are more broadly shared.

REHMSo what steps do you believe the government can and should take?

BERNANKEWell, I just made a list. The -- these are not easy problems. They're not something that's going to be solved in a week or in a bumper sticker. You know, these problems of inequality have been around since at least the late '70s, and we've seen increasing inequality over that entire 30-plus-year period. So these are not easy problems. They're not something that can be fixed, you know, in a quick amount of time.

BERNANKEBut that being said, you know, I mean, ultimately there are a suite of potential responses that could be put together, and my list would be education and skills because people need to be able to compete in a globalized, high-tech economy, improving the tax code.

REHMAll right, let me interrupt.

BERNANKEI can go on for quite a long time if you like.

REHMOkay, let me interrupt you right there because Hillary Clinton, for one, has proposed free tuition for college education. What would you think of that?

BERNANKEWell, I don't think -- I'm not sure she proposed free tuition for all college education. I mean, certainly there are people who can afford -- not everyone can afford college.

REHMExactly, exactly.

BERNANKEAnd I think that -- I think what I would say is that if you have the ability and the desire to complete a college education, that financial factor should not be a reason that you can't do it. In other words, there should be some way that you can do it. So it -- it could be some combination of your own resources, but it could also involve grants, scholarships, loans, a variety of different ways.

BERNANKEI think it's really important for our economy, as well as for our people, our young people, that if you are able to compete college, and you want to complete college, you have the desire, that the fact that your family doesn't have the income should not be a reason that you can't do it. Now how best to work that out, I think broad -- if every college were free all the time, then you'd be subsidizing a lot of people who really can afford it. But for the people who can't, obviously it would be good to give them the kind of help they need to be able to go to school.

REHMAll right, let's go to Julie in Hillsdale, Michigan. Hi, you're on the air.

JULIEThank you for taking my call, Diane.

REHMSure.

JULIEI love your show, and Mr. Bernanke, you're talking to a bank regulator that took down banks during the 1980s, as well as the savings and loans through the middle '90s. And I -- I can just say that there were hundreds of people that did go to jail. Continental Illinois National Bank, which was taken down in the middle '80s, over 130 people were put in jail. And we even took down a federal district bank at the end of the '80s, District of Mississippi went down.

JULIEAnd during the '90s, after we had done everything, never took a bailout, nothing was given to the banks, we just worked it as regulators, we were allowed to do what we could do, we watched everything unravel and all of our ability to stop things took -- were taken away. By the time I left, we could see it coming because all of a sudden we were giving -- Congress was passing laws that allowed everybody to have all this homes without having any background checks or anything.

JULIEWe were prevented from doing what we used to do. We just, we saw a 400 percent increase in homeownership alone, I think, from 1992 to '96, and we weren't allowed to go in and see what was happening to the system and what the banks were doing because we were trying to give everybody this homeownership thing. And it was kind of terrible to see it unraveling when I left in the late '90s.

JULIEBut all I'm saying is regulators, we did our job. I mean, we had the worst year during the middle '80s, 1986-'87, we closed more banks than the worst year of the Depression. And there weren't panics, there weren't anything. We just went in there and slogged it out and took the assets and worked them. So it's kind of like we thought it was going to occur as regulators in the early 2000s. The rank and file knew what was going on. Congress did not.

JULIESo it's kind of funny. You know, I know you guys have done the best you can, but it is really strange from our viewpoint as regulators that we weren't doing our jobs. No, the laws prevented us from going in because they were just giving loans away.

REHMHow do you react to that statement, Mr...

BERNANKEWell, I mean, it's correct that there was a lot of deregulation in the late '90s and early 2000s, and some of it was unwise. If you look at who was overseeing whom, I mentioned Lehman not having a legal supervisor, but something -- only like something like a quarter of all the subprime loans were made by federally supervised financial institutions. Most of them were made by, you know, strip mall mortgage lenders, who, if there were supervised at all, it was by state regulators.

BERNANKESo it was a lot of gaps in the system, and I agree with that. I also agree with the point that there was too much willingness in the interest of homeownership to overlook some bad lending. I think one of the distinctions that was very important in advance of the crisis was the distinction between what was called subprime lending and what was called predatory lending, and it was clear that predatory lending, where basically the borrower was being cheated in some way, was a bad thing, and it was important to stop that, but at the same time there was all these efforts saying, well we want to be very careful in what you do because you don't want to stop legitimate, so-called, unquote, subprime lending, which was providing more homeownership opportunities to lots of people.

BERNANKESo between regulation, the fact that the financial regulatory system was quite fragmented, and many parts of the system were not covered, and the strong political and other pressure to promote homeownership, I agree with the caller that that was part of the reason why things got out of control.

REHMAll right, and to, let's see, Chesterfield, Missouri. Wayne, you're on the air.

WAYNEMy wife and I are in our mid-70s. In our younger years, we lived within our means, we paid our bills, and we saved money. Now, your policies come along as we're in our retirement years, and we're getting .20 on our certificates of deposit. Have you any idea, Mr. Bernanke, how many lives like ours, the quality of life you have diminished because of your policies? What do you say to us?

BERNANKEWell, I would say that you're pointing in the wrong direction here because the -- first of all, the reason interest rates are low is it's a global phenomenon. It's happened because there's a huge amount of savings in the world looking for a relatively small number of good investments. If the Fed, and the Fed is simply, you know, accommodating that fact, that's where we are, if the Fed raised interest rates prematurely, it would put the economy back into recession, and interest rates would go back down.

BERNANKESo the Fed is trying to get the economy strong enough that it can sustain higher interest rates.

REHMSo you would agree...

BERNANKERaising rates earlier than that -- what?

REHMYou would agree with Janet Yellen's decision, the Fed's decision, to keep it at zero, perhaps through the end of the year?

BERNANKEWell, I don't think there's any way, there's any way to get -- I mean, I understand that -- Wayne's concern, and I don't -- I appreciate that it's difficult to live with low interest rates if you're a saver. I understand that. I don't mean to not be sympathetic about it. But it's not really the Fed. It's just the fact that demand for -- there's just not enough real return -- the economy isn't strong enough to provide the kind of returns that people are used to, and the Fed is just trying to help the economy recover. That's really all it can do.

REHMAnd you're listening to "The Diane Rehm Show." And let's see one comment on Twitter from John. What's the best thing we can do to get the economy going now at a faster rate?

BERNANKEWell, I'm not sure there's an obvious solution. Right now some of our problems are emanating from the international economy. You know, one of the main drags on our recovery right now is the fact that China is slowing, and we're seeing slow growth in emerging markets and the like, and that's effecting our economy, as well.

BERNANKESo in the short run, the Fed is doing what it can, and that involves low interest rates, which I understand is a problem for savers. You could have -- you could get somewhat more fiscal policy. You could get, say, more infrastructure spending, for example, and that would have been extremely helpful a few years ago, maybe now a little bit less so but still would be, I think, worth doing.

BERNANKEBut in the longer, this is again, as I say, it's looking for overnight solutions. Unfortunately, it's not going to work. We really need to make our economy more productive. That means improvements in many different dimensions, from the tax code to the education system.

REHMFinally, how have these years affected your personal life?

BERNANKEWell, it was a very difficult time, obviously, and very high stress. I tried to give myself breaks. I'm a baseball fan. I like to go to the games. It's -- Washington Nationals, professional baseball team. I like to give myself time off when I could. But obviously it was a very, very difficult time. I tried to stay focused on what was the main goals. I tried to each day figure out what I had to accomplish that day and how it was going to advance our objectives.

BERNANKESo I tried to stay focused. I tried to give myself a little time now and then to get a breather. But it's certainly not an experience I would be looking to go through again.

REHMAnd what will you do now? You're at the Brookings Institution.

BERNANKEYeah, I'm at the Brookings Institution, which is a think-tank in Washington. And I have been working on the book, obviously, and I'm doing research, writing lectures. I've been giving lectures around the country. I have a blog, which I'm going to go back to posting. I've taken a little bit of a break because of the book, but I'm going to go back to posting there. So I want to remain engaged in public policy decisions and debates. But I'm glad to be, so to speak, a civilian now and out of government and back into the public-private sector.

REHMBen Bernanke, his new book is titled "The Courage to Act: A Memoir of A Crisis and Its Aftermath." Thank you so much for joining us.

BERNANKEThank you.

REHMAnd thanks, all, for listening. I'm Diane Rehm.

After 52 years at WAMU, Diane Rehm says goodbye.

Diane takes the mic one last time at WAMU. She talks to Susan Page of USA Today about Trump’s first hundred days – and what they say about the next hundred.

Maryland Congressman Jamie Raskin was first elected to the House in 2016, just as Donald Trump ascended to the presidency for the first time. Since then, few Democrats have worked as…

Can the courts act as a check on the Trump administration’s power? CNN chief Supreme Court analyst Joan Biskupic on how the clash over deportations is testing the judiciary.